Source: The Art Newspaper

Who This Article Is For

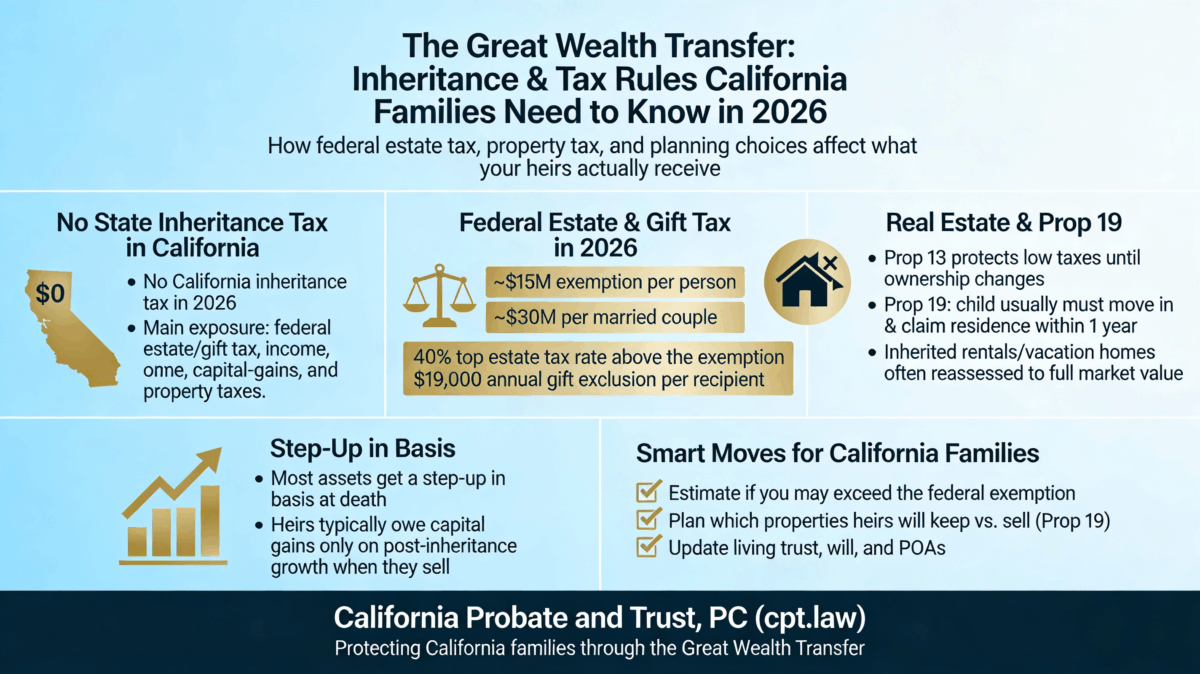

If you’re a California resident managing family assets, planning your estate, or concerned about how inheritance taxes will affect your children’s financial future, this guide explains the complex tax landscape you’ll face in the coming decade. As Baby Boomers transfer an estimated trillions of dollars in wealth, understanding these rules now can save your family from unnecessary tax burdens and difficult decisions later.

Why Inheritance Tax Planning Matters More Than Ever

The so-called “great wealth transfer” is underway. As the Baby Boomer generation ages, experts predict that billion-dollar estate sales will become routine in the next decade. What was once a $100 million “meaningful sale” in 2016 barely registers today.

For California families, this creates both opportunity and risk. Without proper planning, your heirs may be forced to sell cherished assets—whether real estate, family businesses, or investment portfolios—simply to pay tax obligations.

How Do US Estate Taxes Work? A California Resident’s Guide

In the United States, estate taxes operate at both federal and state levels. Here’s what you need to know:

Federal Estate Tax Rules (2026)

California-Specific Considerations

While California itself does not impose a separate state estate tax, if you own property or have business interests in states like New York, you may face additional state-level estate taxes with their own thresholds and rates.

Understanding Capital Gains Tax on Inherited Assets

Capital gains tax (CGT) adds another layer of complexity to inheritance planning. In the US, beneficiaries benefit from what’s called a “step-up in basis”—the inherited asset’s tax value resets to its fair market value at the date of death.

Real-World Example:

If your parent purchased California real estate for $200,000 in 1985 and it’s worth $2 million when they pass away, you inherit it at the $2 million valuation. If you later sell it for $2.5 million, you only pay capital gains tax on the $500,000 appreciation after inheritance—not on the full $2.3 million gain since original purchase.

Why Professional Valuation Is Critical

Getting an accurate, recent valuation is the first step in estate planning. However, many families are in for surprises:

The Hidden Challenge: When Heirs Can’t Afford to Keep Family Assets

According to estate planning experts, the most common concern among collectors and asset holders is preserving their legacy while reducing the burden on their children. Unfortunately, “more often than not, the kids can’t afford to keep the collection—or just don’t want it—because it’s impossible to pay the estate tax obligations and keep the collection”.

Case Study: The de la Cruz Museum

Rosa de la Cruz created her own museum in Miami in 2009. When she died in February 2024, her husband Carlos closed the museum in March and sold off the entire collection to pay taxes and operating costs. As one expert noted, this is “a sad and cautionary tale about how what you want isn’t necessarily what your heirs want”.

Children of devoted collectors sometimes feel resentful: “This was an obsession for so long, it took time away from me, I’m over it”.

What Estate Planning Options Work for California Families?

If you’re wondering “how can I protect my family from excessive estate taxes,” here are proven strategies:

1. Lifetime Gifting Strategy

2. Creating a Private Foundation or Museum

3. Strategic Sale During Your Lifetime

4. Professional Trust and Estate Planning

Working with experienced California estate planning attorneys who understand both the legal structure and financial management aspects of wealth transfer is essential. They can help you:

How UK and French Rules Differ (For International Families)

If you have family connections or assets abroad, understanding international differences is important:

United Kingdom

France

What Questions Should I Ask an Estate Planning Attorney?

When meeting with an estate planning professional, California residents should ask:

Take Action Now: Protect Your Family’s Future

The great wealth transfer is already underway, and the families who plan ahead will preserve the most for the next generation. Whether you’re concerned about real estate holdings, business assets, investment portfolios, or family collections, professional guidance makes the difference between a smooth transition and a forced liquidation.

California Probate and Trust, PC helps California residents navigate the complexity of estate planning and probate with transparency and compassion. Our experienced attorneys provide comprehensive estate planning services—from simple wills to complex trust structures—designed to protect your family and preserve your legacy.

Schedule Your Free Estate Planning Consultation

Contact California Probate and Trust, PC today for a no-obligation consultation. We’ll review your family dynamics, assess your estate planning needs, and help you choose the right strategy to protect what matters most.

Visit cpt.law or call to speak with a qualified California estate planning attorney.

Legal Disclaimer

This article is provided for informational purposes only and does not constitute legal advice. Estate planning and tax laws are complex and subject to change. The information presented here is based on current federal tax law as of February 2026 and may not reflect the most recent legislative changes. Each family’s situation is unique, and the strategies discussed may not be appropriate for your circumstances. You should consult with a qualified estate planning attorney and tax professional before making any decisions regarding your estate plan. California Probate and Trust, PC is available to provide personalized legal guidance tailored to your specific needs and California residency status.