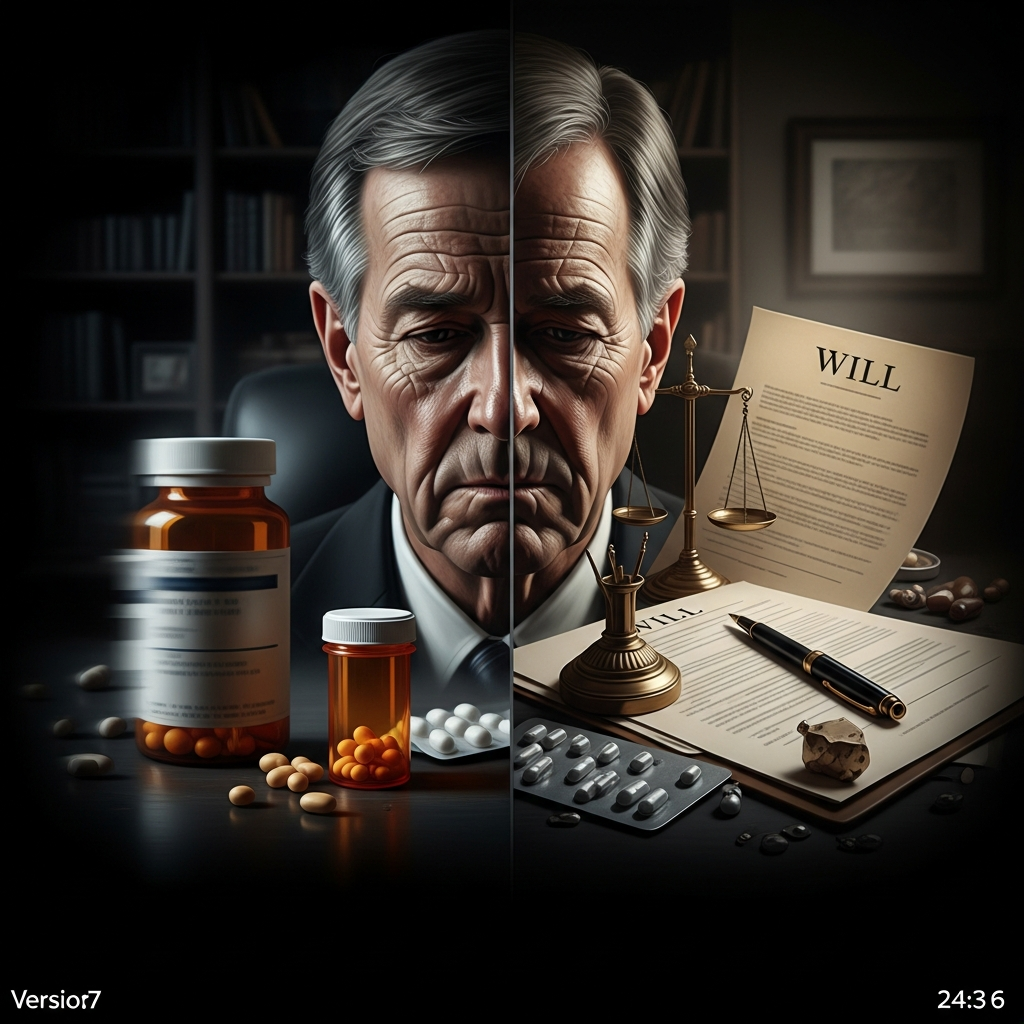

The recent FBI investigation into the death of Indianapolis Colts owner Jim Irsay highlights critical issues that California families managing substantial assets should understand—particularly when addiction, prescription medications, and sudden death intersect with estate administration.

What Happened to Jim Irsay?

Jim Irsay, the former owner of the NFL’s Indianapolis Colts, died in May 2025 at age 65. According to documents reviewed by The Washington Post, the FBI is now investigating both his death and the recovery doctor who provided him with prescription pain pills and ketamine during his final months.

Irsay had a well-documented struggle with addiction and was receiving opioids and ketamine from a California recovery doctor. This tragic case raises important questions for families managing estates, particularly when substance abuse or medical complications are involved.

Why This Matters for California Estate Planning

If you’re a California resident managing substantial assets—or if you’re concerned about protecting your family’s legacy in the face of addiction or health challenges—the Irsay case illustrates several critical estate planning considerations:

How Can California Families Protect Themselves?

Whether you’re concerned about addiction, sudden illness, or simply want to ensure your family is protected, here are essential steps every California resident should consider:

What Questions Should You Ask Your Estate Planning Attorney?

When meeting with an estate planning lawyer, California residents should ask:

The Intersection of Healthcare and Estate Planning

The Irsay case underscores how healthcare decisions and estate planning are deeply intertwined. California residents should ensure they have:

Why California Probate and Trust Can Help

At California Probate and Trust, PC, we understand that estate planning isn’t just about paperwork—it’s about protecting the people you love during life’s most challenging moments. Our experienced Sacramento-based attorneys specialize in helping California families navigate complex estate planning situations, including those involving addiction, sudden death, and family dynamics that require sensitive, strategic planning.

We offer transparent, comprehensive estate planning packages designed specifically for California residents who want to protect their families and preserve their legacies. Our approach combines legal expertise with compassionate guidance, ensuring you feel confident and in control of your future.

Take Action Today

Don’t wait for a crisis to protect your family. Schedule a free consultation with California Probate and Trust, PC to discuss your estate planning needs. Whether you’re concerned about addiction, want to avoid probate, or simply need peace of mind that your family is protected, our experienced attorneys can help you create a comprehensive plan tailored to your unique situation.

Contact California Probate and Trust, PC today to schedule your free estate planning consultation. Call (866) 674-1130 or visit our offices in Fair Oaks, Sacramento, or San Francisco.

Legal Disclaimer

This article is provided for informational purposes only and does not constitute legal advice. The information presented here is based on publicly available news reports and general estate planning principles. Every family’s situation is unique, and estate planning strategies should be tailored to individual circumstances. Nothing in this article creates an attorney-client relationship. For specific legal guidance regarding your estate planning needs, please consult with a qualified California estate planning attorney. California Probate and Trust, PC is a law firm based in California, and this information is intended primarily for California residents. Laws vary by state, and this content may not apply to residents of other jurisdictions.

Source: The Washington Post – “FBI is investigating the death of Indianapolis Colts owner Jim Irsay”