If you’re a California business owner with a buy-sell agreement in place, or if you’re managing the estate of someone who owned shares in a closely held corporation, a recent Supreme Court decision could significantly impact how the IRS values those shares for federal estate tax purposes.

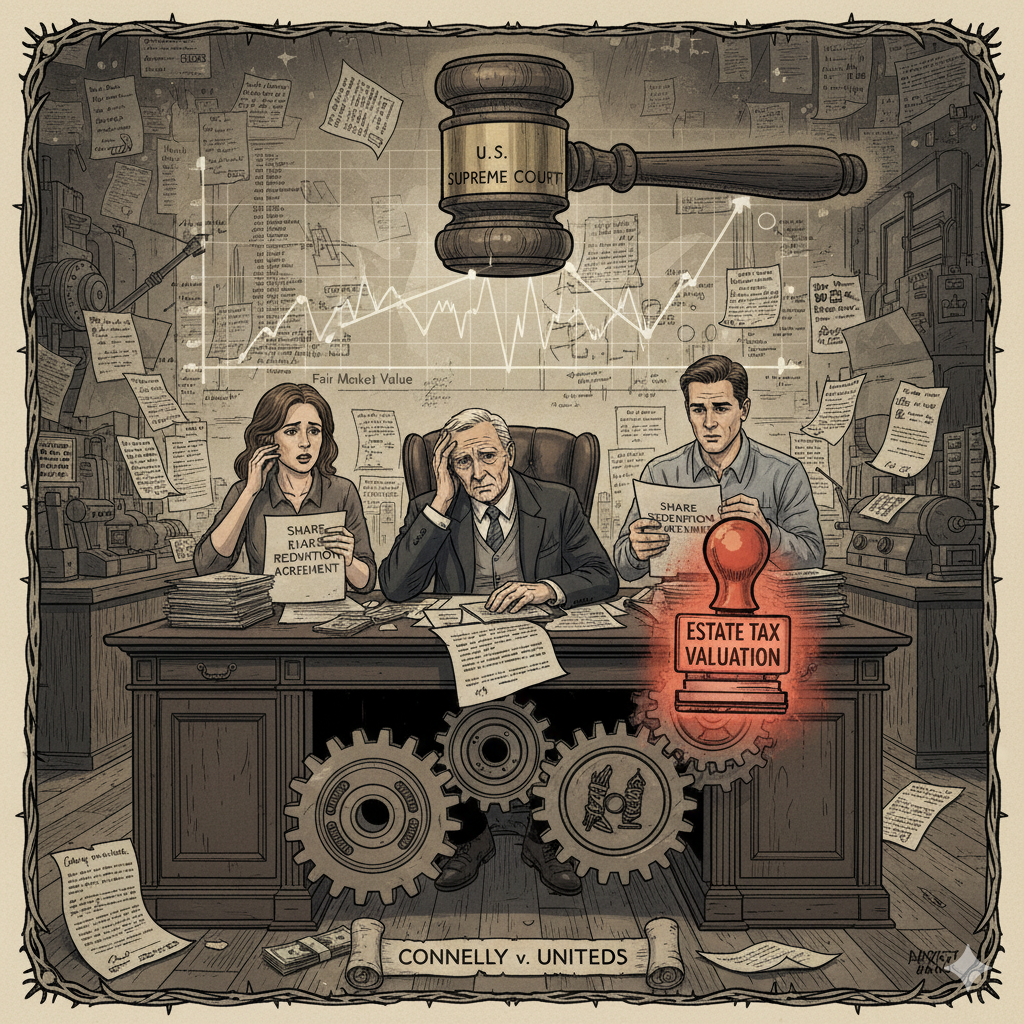

What Is Connelly v. United States?

In Connelly v. United States, the Supreme Court clarified a critical issue: A corporation’s contractual obligation to redeem shares does not automatically reduce the corporation’s value for federal estate tax purposes.

This ruling is particularly important for families and business owners in California who use life insurance-funded buy-sell agreements to ensure smooth ownership transitions when a shareholder passes away.

Who Does This Affect?

This decision is relevant if you:

- Own shares in a closely held or family-owned business

- Have a buy-sell agreement that requires the corporation to purchase a deceased owner’s shares

- Are an executor or trustee handling an estate that includes business ownership interests

- Are planning your estate and want to minimize tax exposure for your heirs

Why Does This Matter for Estate Planning?

Many business owners assume that because the company is obligated to buy back shares upon an owner’s death, that obligation reduces the company’s net value—and therefore reduces the taxable estate. Connelly says otherwise.

The Court held that the redemption obligation is not treated as a liability that offsets the value of the corporation. As a result, the IRS may value the decedent’s shares higher than expected, leading to a larger estate tax bill.

Real-World Example

Imagine two siblings co-own a California-based manufacturing business. They have a buy-sell agreement funded by life insurance. When one sibling dies, the corporation uses the insurance proceeds to buy out the deceased sibling’s shares.

Before Connelly, some estate planners argued the buyout obligation reduced the company’s value. Now, the IRS can argue the full value of the shares—plus the insurance proceeds—should be included in the estate, potentially triggering unexpected estate taxes.

How Can You Protect Your Family and Your Business?

If you’re a California resident with business interests, here’s what you should consider:

- Review your buy-sell agreements. Work with an experienced estate planning attorney to assess whether your current agreement exposes your estate to higher taxes.

- Explore alternative structures. Cross-purchase agreements (where individual owners buy each other’s shares) may provide different tax outcomes than entity-redemption agreements.

- Update your estate plan. Make sure your will, trust, and financial plans account for the true tax impact of your business ownership.

- Consult with professionals who understand California law. Estate and business succession planning requires coordination between legal, tax, and financial advisors.

How California Probate and Trust, PC Can Help

At California Probate and Trust, PC, we specialize in helping California families navigate complex estate planning challenges—including business succession, trust administration, and probate. We understand that planning for the future of your business isn’t just about taxes; it’s about protecting the people and legacy you care about most.

Whether you’re a business owner concerned about estate taxes, an executor managing a complex estate, or a family member trying to understand your options, we offer transparent guidance tailored to your situation.

Take the Next Step

Don’t let a Supreme Court ruling catch you or your family off guard. Schedule a free consultation with our experienced estate planning attorneys to review your buy-sell agreements, update your estate plan, and ensure your business and family are protected.

📞 Call us today at (866) 674-1130 or schedule your free consultation online.

Source: California Lawyers Association – Connelly v. United States