Who This Ruling Protects

If you’re a California resident who serves as a trustee for a special needs trust—or if you’re concerned about protecting a loved one with disabilities while preserving their eligibility for public benefits—this Third District Court of Appeal decisionprovides critical clarity on trustee discretion and what constitutes proper trust administration.

## The Central Question: What Are “Special Needs”?

When administering a special needs trust in California, trustees often face a difficult question: What expenditures are allowed under the trust’s definition of “special needs”? Can a trustee provide for quality-of-life improvements, or must distributions be limited only to medical necessities directly related to the beneficiary’s disability?

The McGee case (C093796, filed May 24, 2023)answers this question decisively in favor of broader trustee discretion.

## What Happened in McGee v. State Dept. of Health Care Services

Daniel, serving as successor trustee of a special needs trust for beneficiary Dianna, filed an account showing various trust distributions. The trial court determined that Daniel had abused his discretion by making payments for items that didn’t constitute “special needs” as the court narrowly defined them.

The trial court’s interpretation was restrictive: it held that “special needs” meant only items or services directly related to limitations caused by the beneficiary’s disability. Under this standard, the trustee was surcharged for expenditures that fell outside this narrow purpose.

## The Appellate Court’s Reversal: A Broader Standard

The Third District Court of Appeal reversed, holding that the trial court applied the wrong legal standard. The appellate court concluded that:

## What This Means for California Trustees

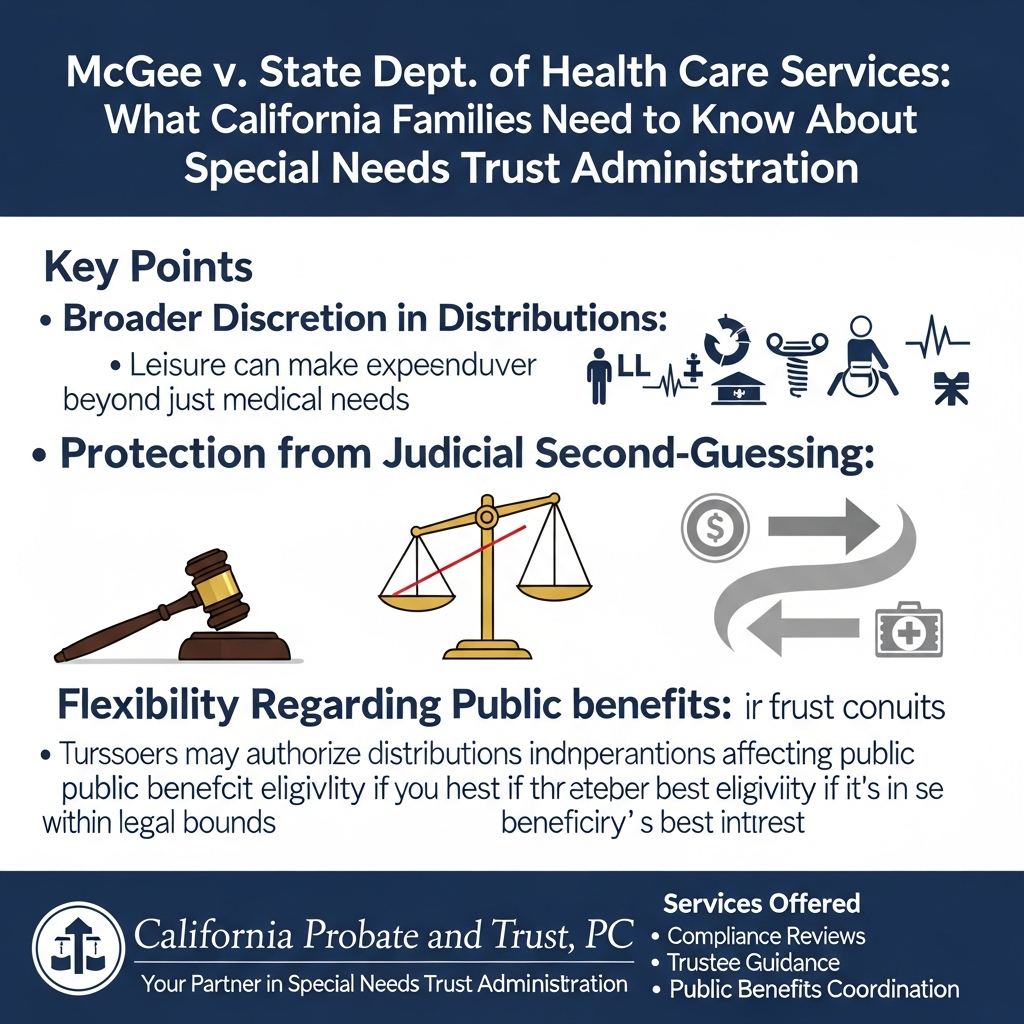

The McGee ruling provides three key protections for trustees of special needs trusts in California:

1. Broader Discretion in Distributions

Trustees are not limited to distributions that address only the disability itself. The trust instrument’s language—read in the context of special needs trust law—permits expenditures that enhance quality of life and general well-being, even if not strictly medical or therapeutic.

2. Protection from Judicial Second-Guessing

Courts cannot impose their own judgment about what constitutes appropriate distributions, as long as the trustee acts within the bounds of the trust instrument and applicable law.

3. Flexibility Regarding Public Benefits

While trustees should consider resource and income limitations of public assistance programs, they may authorize distributions that reduce or eliminate benefit eligibility—provided they make an independent determination that doing so serves the beneficiary’s best interest.

## Real-World Application: When to Seek Guidance

California trustees should consult with experienced special needs trust attorneys when:

## How California Probate and Trust, PC Can Help

Special needs trust administration requires balancing legal compliance, tax efficiency, and the beneficiary’s best interests—all while maintaining transparency with family members and protecting public benefit eligibility.

At California Probate and Trust, PC, our certified estate planning specialists have guided hundreds of California families through the complexities of special needs trust administration. We provide:

Our firm serves as a one-stop resource for both the legal structure and financial management aspects of special needs trusts, helping California families protect vulnerable beneficiaries while minimizing conflict and legal exposure.

Schedule your free consultation today to discuss your special needs trust administration questions with our experienced team.

## Source and Full Opinion

This analysis is based on McGee v. State Dept. of Health Care Services, C093796 (Cal. Ct. App. May 24, 2023). The full opinion is available from the Third District Court of Appeal.

—

Legal Disclaimer: This article is provided for informational purposes only and does not constitute legal advice. Special needs trust administration involves complex legal, tax, and public benefits considerations that vary based on individual circumstances. The McGee decision provides important guidance but should not be relied upon without consultation with a qualified California trust attorney. California Probate and Trust, PC offers free consultations to discuss your specific situation and provide personalized guidance. No attorney-client relationship is created by reading this article.